Supercharge Your Parked Fund

Higher returns and greater flexibility with low-risk fixed-income mutual funds

Try with live data

SEBI rated safest funds

Safety, Priority

High Yield

Lower Taxation

Trusted Partners

Smart Fund Recommendation

Just provide an approximate duration and our AI model will brew the best and safest fund selections tailored precisely for your needs. KOFFi takes into account several data points and current trends for its well-informed recommendations for your short term needs.

Your Money, Your Flexibility

Deposit or withdraw any amount, anytime.. while the rest continues to grow at the same rate. Simply tell us when you need funds to be available in your linked bank account and we will take care of the rest.

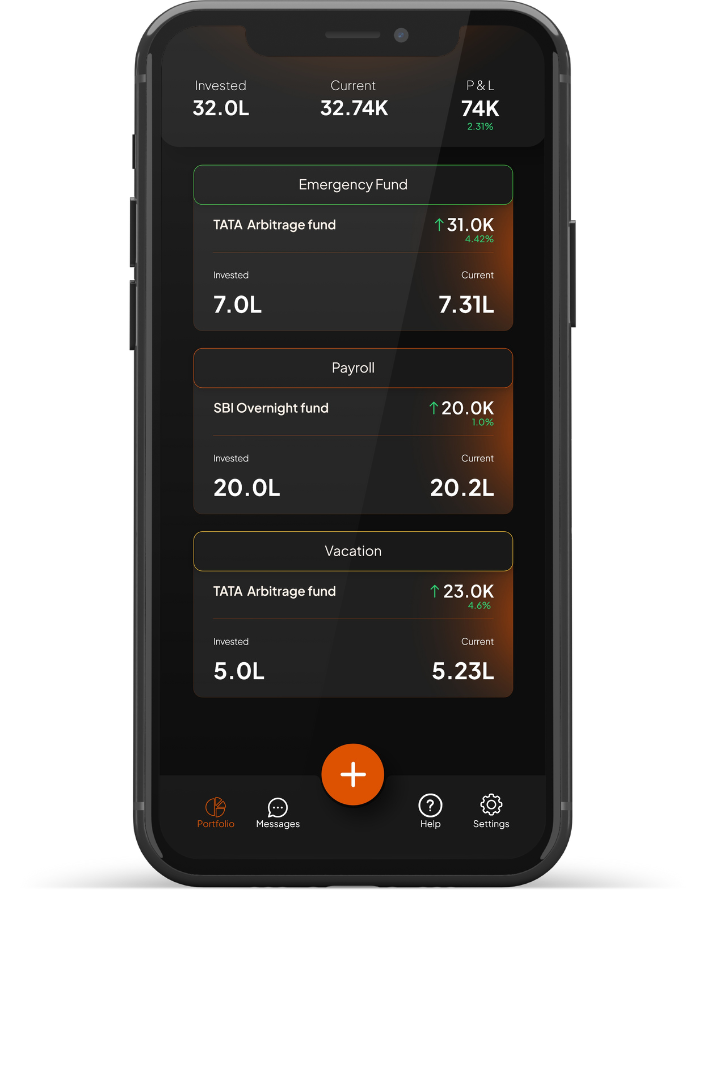

Organise Your Money

A “bucket” is a tool to help you manage and park your money ensuring safe returns. Think of it as a labelled jar specifically for fund parking:

- Received money from clients and need to pay salaries later? Create a “Payroll” bucket.

- Setting aside funds for your child’s tuition due next semester? Put it in a “Fees” bucket.

Seamless & Transparent

Your money never resides with us. KOFFi acts as a secure expressway, driving your funds from your existing bank accounts to trusted fund houses.

We handle all the complexities behind the scenes, enabling you to focus on your work.

Our Mission

The benefits of many financial products often remain the privilege of large institutions and corporations due to the nature of their complexity.

At KOFFi, our mission is to democratize these products by creating innovative tools, forming partnerships, raising awareness and promoting transparency to improve the financial aspect of individuals and businesses.

SEBI Licensed & Regulated

Member

ARN 273638

Member

code 58552

FAQ

Know more about KOFFi

YOUR MONEY NEVER RESIDES WITH US. We aim to provide you with the technology platform to connect with the safest rated financial products where your money will be held by the trusted fund houses like TATA & SBI. The financial products that are offered by KOFFi have been traditionally used by large corporations to keep their short-term funds.

Similar to fixed deposits, curated options provided by the KOFFi are linked with RBI interest rates, but with the added benefit of earning on your daily balances. This makes our fund selection perform much better in short-term as compared to FDs. Additionally, tax friendly and zero penalty options help you maximize yield for your money.

Options in KOFFi like Arbitrage funds are taxed at 15%, as opposed to 30% on traditional instruments like fixed deposits & savings accounts.

In KOFFi, your returns are only taxed when they are realized. Whereas in FD, tax is applicable every year irrespective of the realization.

Arbitrage mutual funds offer lowest risk, since they aim to profit from the known price difference, rather than betting on unknown price movements. For example, a fund manager buys a particular asset priced at ₹90 in Market A and instantly sells the same in Market B, where the price is ₹100, thus making an instant profit of ₹10.

Arbitrage funds enjoy a lower tax rate of 15%.

A debt fund is a mutual fund scheme that invests in diversified AAA rated financial instruments such as government and corporate bonds and securities that offer steady capital appreciation.

A few major advantages of investing in debt funds are high liquidity, safety, low cost structure and better returns in the short term.

While the scheduling of a payout sounds simple, there are various attributes like cut-off time, bank settlement time, holidays etc which makes it complex. Just give us a date and KOFFi will take care of all these complexities to ensure your money is available in your bank account on that date.

It’s a volume game for us, as the commission we earn from our trusted partners is miniscule. Behind the scenes, we work relentlessly to provide you the platform and choices that ensure your funds are safe, growing and available whenever you need them.

KOFFi is a short-term fund parking platform where along with financial products, we plan to offer various tools to organize funds and manage cash-flow.

While we began with mutual funds due to their suitability for our primary use case, our long-term vision encompasses a broader range of secure financial products including T-Bills, Commercial papers and more.

Ask us Anything!

Ask us Anything!